tax benefit rule state tax refund

It shouldnt but it is not programmed like the 1040. In 2022 Veronica received a 4900 refund of the state income taxes she paid in 2021.

Wheres My State Tax Refund Montana.

. The standard deduction for single filers in 2021 was 12550. 12 hours agoAbout 3 million taxpayers will receive a refund in the form of a mailed check or a direct deposit worth about 14 of what they owed in state personal income tax in 2021 the. Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page.

Refunds of amounts deducted on a 1040 -- usually these are state income tax refunds but they can be refunds of other taxes or other expenses like medical -- are not. In years prior to 2019 and the enactment of the Tax Cuts and Jobs Act TCJA taxpayers were accorded an unlimited federal income tax deduction for all state and local. Fill in the blank 2 Expert Answer a.

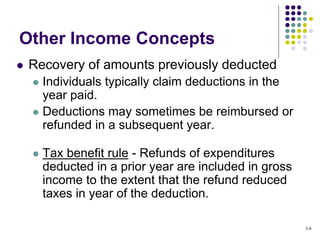

Let me try and parse this out from your numbers. 12 hours agoAbout 3 million taxpayers will receive a refund in the form of a mailed check or a direct deposit worth about 14 of what they owed in state personal income tax in 2021 the. What is the Tax Benefit Rule.

The rule says if a refund can be linked to a prior deduction which the taxpayer. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020. GTC provides online access and can send notifications such as.

If the refund had not been deducted in year 1 itemized deductions would have been only 3500 and the taxpayer would have taken the standard deduction. When the couple paid the excess refund 400 to. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not.

If a state or local income tax refund is received during the tax year the refund must generally be included in income if the taxpayer deducted the tax in an earlier year. Check your refund online does not require a login Sign up for Georgia Tax Center GTC account. Enter the refund as income then back it out As.

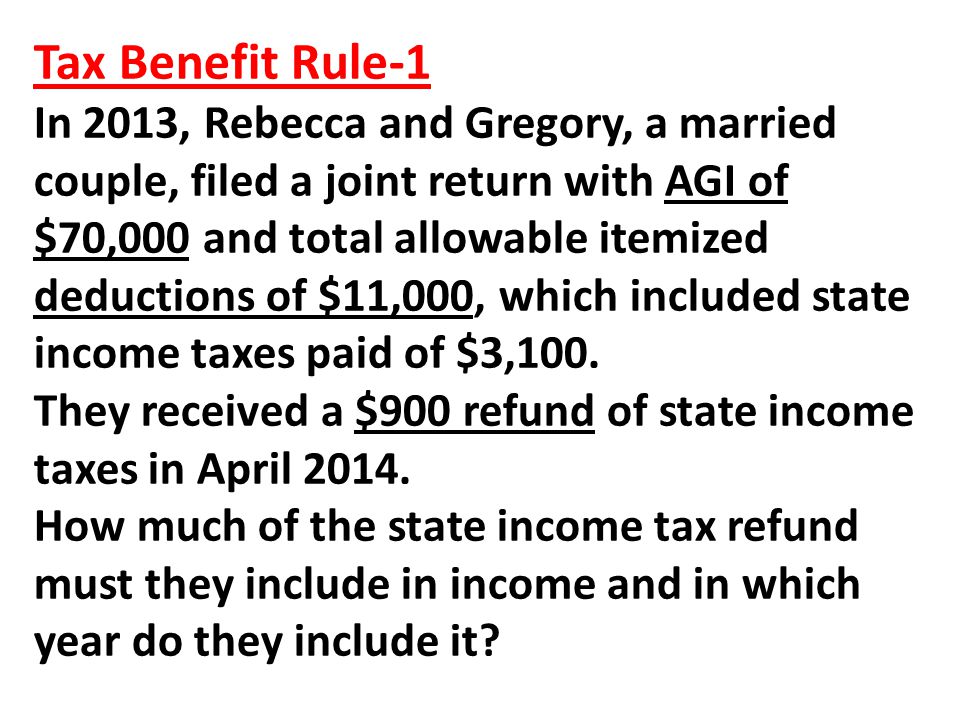

So the tax benefit you received from the 300 refund was only 225. Tax benefit rule tax benefit rule A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income.

Ways to check your status. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. State tax refunds are reported to you on Form 1099-G.

If an amount is zero enter 0. If your federal tax. Had A paid only the proper amount of state income tax in 2018 As state and local tax deduction would have been reduced from 9000 to.

Myrna and Geoffrey filed a joint tax. Under the tax benefit rule the state refund is only deductible up to the point where you get a tax benefit from deducting it. Tax Benefit Rule Whether state refunds are includable on a federal return depends on the tax benefit rule.

1500 refund of state income taxes paid in 2018.

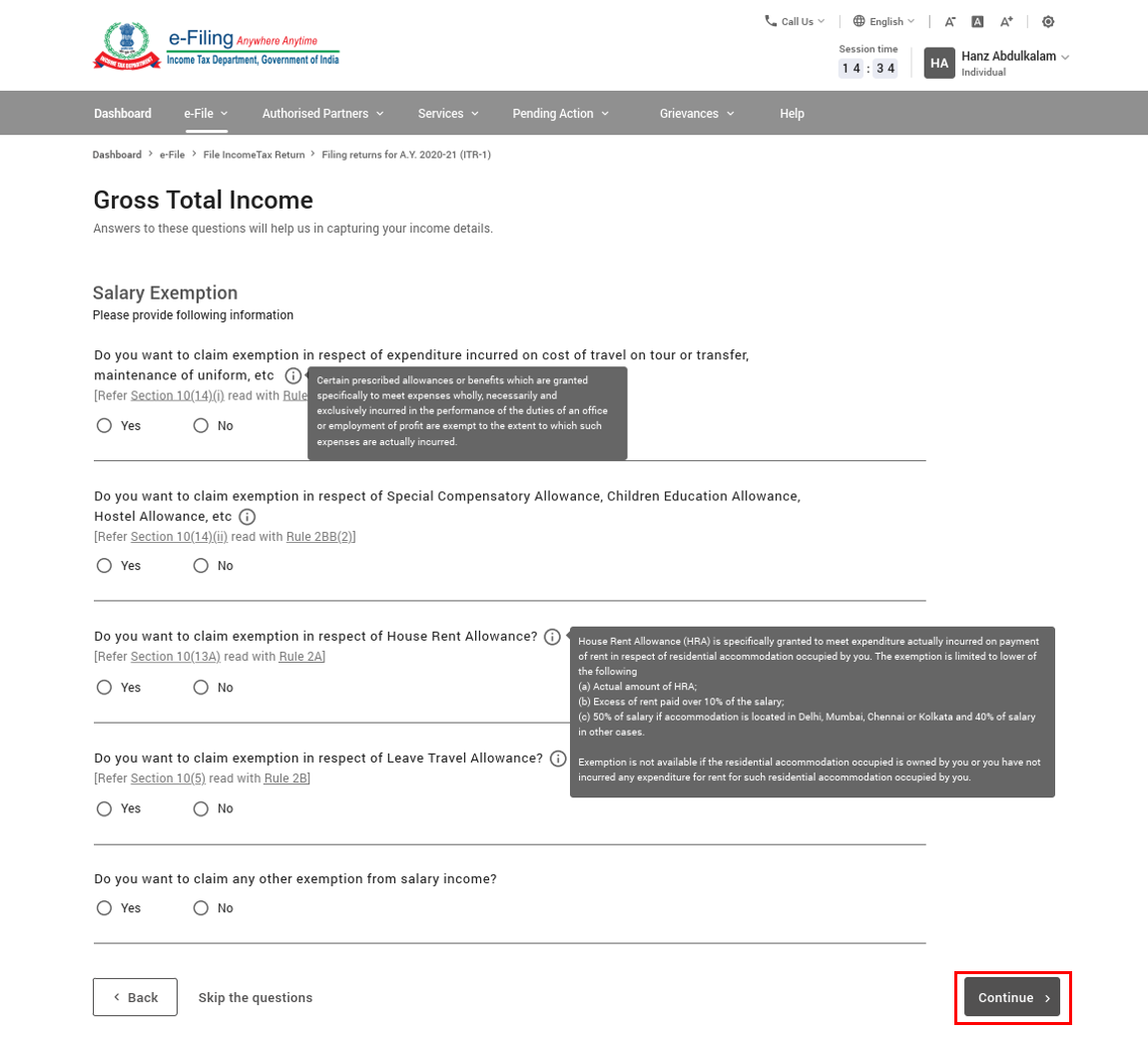

Identification And Generation Of Applicable Itr User Manual Income Tax Department

Chapter 8 Income Taxation Of Individuals Exemptions Ppt Download

Tax Returns For 2005 Have New Rules

Salt Refunds Clarified By The Irs Frazier Deeter Llc Frazier Deeter Llc

Under New Law Is A 2018 State Tax Refund Received In 2019 Considered Taxable Income In 2019

Spilker 10e Chapter 05 Tb Mcgraw Hill S Taxation Of Individuals And Business Entities 2019 10e Studocu

Effects Of Tcja On Salt Refunds

Are State Tax Refunds Taxable The Turbotax Blog

Chapter 2 Income Tax Concepts Kevin Murphy Mark Higgins Ppt Download

Taxes 2021 Batis Prezentaciya Onlajn

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Tax Aide State Local Income Tax Refunds Form 1040line 10 Pub 4491page Ppt Download

What Are The Income Tax Benefits For Doctors Sqrrl

Toaz Tax Multiple Choice Cpa Review School Of The Philippines M A N I L A Gross Income Exclusions Studocu

10 Things Everyone Should Know About Taxation